Unique Medical Stop-Loss Alternative

We are happy to work through Brokers or directly with HR and Benefits Professionals

“The County saved more than 50% on the cost of our stop-loss coverage for 2022 alone thanks to joining PHSLP. We like the program’s retroactive funding structure and having the volatile risk spread across a pool of participating organizations. As members, we also appreciate the transparency related to its operations and cost.”

- RITA DAVIS, FINANCE MANAGER, ANDERSON COUNTY

Medical stop-loss coverage is a product that provides protection for a health plan against catastrophic or unpredictable losses.

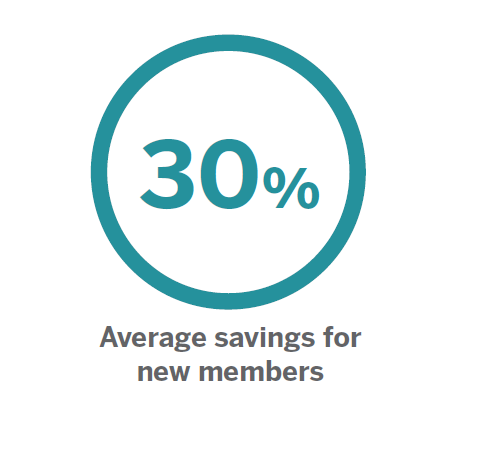

Antum Risk offers a captive stop-loss program utilizing a retrospective funding model where members pay actual costs – eliminating much of the profit and removing the surplus and margins found in commercial stop-loss. Risk is spread across a pool of participating members, lessening the effects of this volatile line of coverage.